A career in investment banking can be extremely rewarding, adventurous, and lucrative but does require resilience, commitment, and working under pressure. Investment bankers facilitate corporate transactions such as M&As, IPOs, and LBOs, among others, for businesses. The convergence of emotional and rational aspects required for these tasks influences the types of skills bankers look for in candidates.

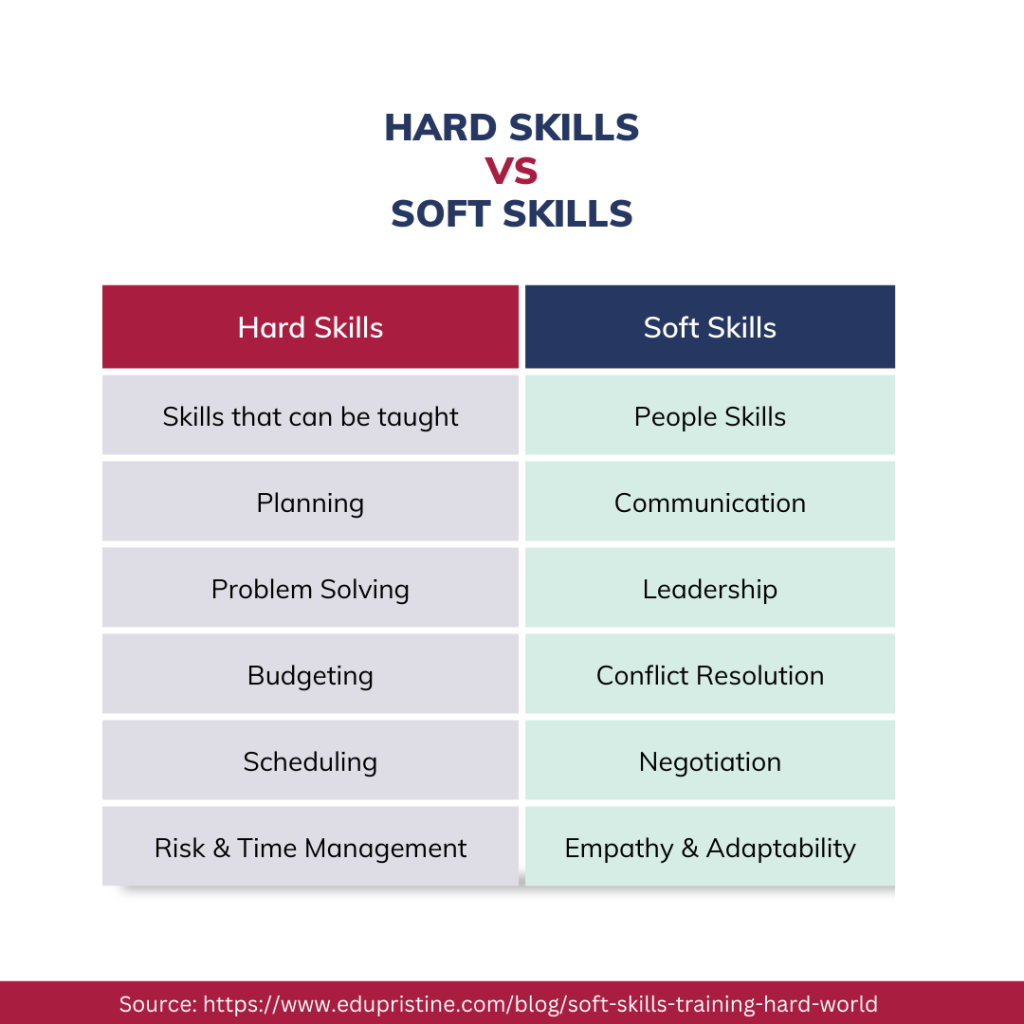

In the midst of financial models and valuation techniques, soft skills are often overlooked. However, their importance can’t be overstated. Soft skills are non-technical, non-job-specific skills which are relevant in every profession. The good news is soft skills can be easily developed and improved upon with practice. In this article, we will explore the soft skills required in IB and how one can improve upon them.

Communication

One of the crucial aspects of investment banking is the ability to cater to clients, superiors, and corporates. Presenting an idea requires comprehensive communication and presentation skills, which include spreadsheets, documents, and slideshows. An investment banker must be able to distil the core points and effectively convey them to the management to close a deal.

There’s no better way to improve your communication than to talk regularly with industry professionals and people in business. You can also challenge yourself to step out of your comfort zone when it comes to speaking in public. Great communication comes with high self-confidence, hence, it’s important to ensure that you are up-to-date with the markets. You can refer to informative podcasts to be well acquainted with the environment of the financial markets.

Knowing how to sell

A big part of investment banking requires you to communicate and convenience different stakeholders involved in the deal. You will, in many ways, be like a salesperson. As part of the salesforce, you must bring in revenues and have an understanding of the service that you are delivering.

Indeed, many people are naturally born with this skill, but you can develop and improve upon it by reading books on sales and practising it through shadowing others or early in your college or career. This will allow you to have first-hand experience in dealing with customers. You can also take up jobs in the broking industry (sell side) to learn about sales in the finance industry.

Relationship Building

Investment banking is a people’s business, and humans are social beings. You can’t expect to do business with a firm without a healthy and trusted relationship. Skills such as being able to deal with management in difficult situations and a positive attitude that asserts power but is also understanding at the same time are valuable. Developing and maintaining client relationships are traits that an investment banker must have.

To develop meaninful relationships and improve upon your skills, you should try pay attention to other people’s interests and problems and gradually become more personal with them. Furthermore, you can try talking with people you don’t usually speak up with or try to win more friends. You can observe other people, who are good at maintaining relationships or at least are known to be good around people. Over time, you’ll be able to observe hints or tricks on how you can be more efficient in building relationships with clients.

Open mindedness

Being open-minded paves the way to a deeper understanding of markets, cultures, and societies and ignites out-of-the-box thinking. It allows an individual to refer to multiple disciples to solve a problem or close a deal, leading to creative problem-solving. This expands their ability to work with international businesses and across sectors. Combining this understanding with an ability to communicate effectively is a sought-after skill in investment banking. The ability to do so in more than one language is an added bonus.

To accept new ideas, you must be aware of global events. This can be enhanced by reading and talking to people from different fields. Another way to improve is by participating in study abroad programs, which promote open-mindedness.

Discipline

The salaries and bonuses of investment bankers are often discussed but little is said about the long working hours, hard work, and diligence that goes behind them. This requires strong self-discipline. Investment bankers, right from the beginning, work in a very high-pressure environment, because of which they must be able to perform under intense scrutiny and demands.

Self-discipline is often an innate quality but it can be learned throughout life in multiple ways. Trying to finish tasks on time and consistently is a remarkable way to develop discipline as a habit.

Conclusion

A certain personality and skill set can help you succeed in investment banking, much of which can be taught and learned. Excellent communication, self-discipline, and open-mindedness, along with the ability to network and maintain relationships is extremely crucial for a career in investment banking. Additionally, the best way to develop and improve upon soft skills mentioned is by practising and incorporating them into your daily life.

60+ hours

60+ hours 9 courses

9 courses